Credit Tradeline

A credit tradeline, also known as a credit account, is a detailed record that tracks a borrower's credit activity. This comprehensive report includes essential information such as the type of credit, credit limit, payment history, and any outstanding balances. Maintaining a positive tradeline is vital as it can significantly impact your credit score and enhance your eligibility for obtaining loans or credit cards.

Having a strong tradeline demonstrates to lenders and financial institutions that you are a responsible borrower. It shows that you have a history of making timely payments and effectively managing your credit. This, in turn, increases your chances of being approved for future credit applications and may even result in more favorable terms and interest rates.

- Monitor your credit regularly to identify errors or discrepancies.

- Keep credit utilization low by paying off balances in full each month.

- Maintain a diverse mix of credit accounts to demonstrate responsible borrowing.

- Avoid opening multiple new accounts simultaneously to minimize credit inquiries.

Following these tips will help you build and maintain a strong credit tradeline.

To maintain a good tradeline, it is crucial to practice healthy credit habits. This includes making all payments on time, whether it's for credit cards, loans, or other forms of credit. Late or missed payments can have a negative impact on your tradeline and potentially lower your credit score.

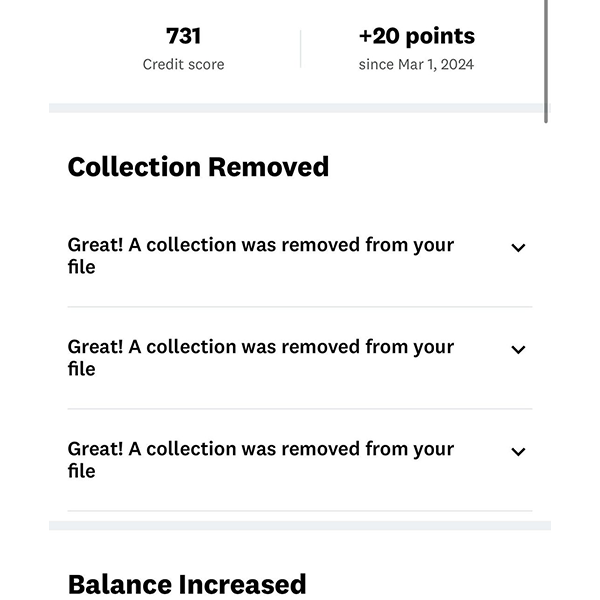

Another Massive Gain here! We removed the last 3 collections that were on the file for this client, now we landed a sweet 731 Credit score. This client goal was to secure funding and start up with their business idea!! Looks like we delivered. We took this score from a 578 to now 731🔒 🎉 2024, We’re getting your buying power back.

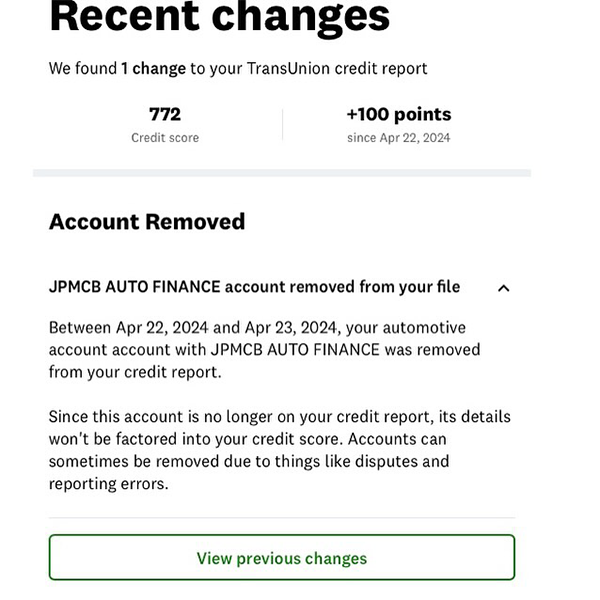

This client was just in the 500s 2 months ago😳. Here, we make dreams come to reality 💪🏾

4 Days, up 138pts now that’s Crazyyyy👏🏾👏🏾 These are obviously rare cases! I’m not out here promoting this like it will absolutely happen for you specially at this speed, but you get the point! We get the Work done‼️

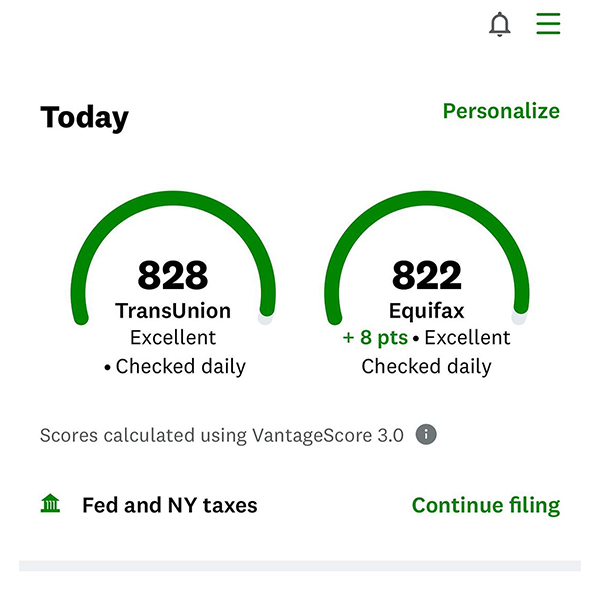

We got this client to a 828😳😳😳 This process took 60days !! It’s very exciting when your client has a higher score than you. 😭😩 When the system works, the system works!!

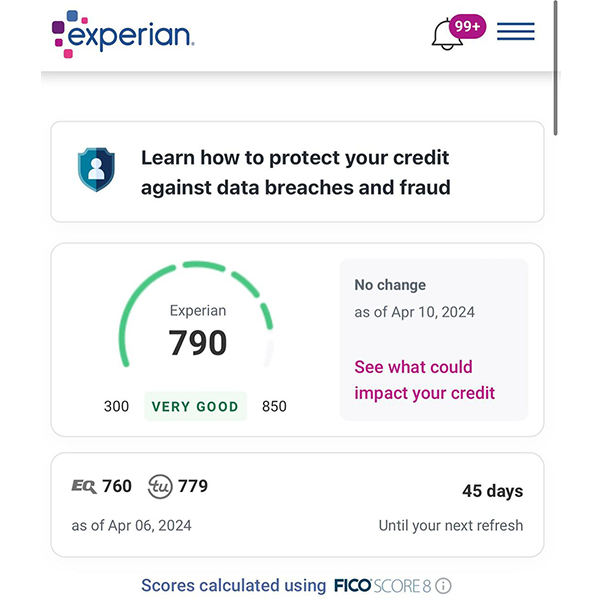

Swish!!!!!!!‼️👏🏾☺️ This client is literally now in the process of closing on a beautiful home. This Year, We’re taking Credit! Real Estate! Investments! Insurance! Wills! And Trusts!!